In-country partner (ICP) for payroll is a strategic global payroll solution that enables companies to outsource and pay international employees through established local entities, ensuring full compliance with country-specific regulations while eliminating the need to set up your own legal entities abroad.

As remote work continues to reshape the global talent landscape, ICP payroll has become an essential tool for businesses seeking to build international teams quickly and compliantly.

ICPs manage critical employment functions including payroll processing, tax withholding, benefits administration, and compliance with local labor laws. They essentially become the legal employer in that country while you maintain day-to-day management of the employee's work and responsibilities.

This arrangement is sometimes called an Employer of Record (EOR) service, though ICPs often provide broader services beyond employment administration. For multinational companies and growing businesses, ICPs offer a pathway to global expansion without the significant investment and risk of establishing legal entities in every country of operation.

How does ICP payroll work?

The ICP payroll process involves identifying suitable partners, establishing contractual relationships, onboarding employees, processing regular payroll, handling compliance, and maintaining ongoing management. These steps are listed in detail below.

Identifying suitable partners: You select an ICP with established legal entities in your target countries. This may be a global EOR provider with a network of entities or individual partners in specific regions.

Establishing contractual relationships: You sign a service agreement with the ICP outlining responsibilities, fees, and terms. The ICP then creates compliant employment contracts for your workers based on local requirements.

Onboarding employees: The ICP legally hires your selected candidates or transitions existing contractors to employee status. They collect necessary documentation and register employees with local authorities.

Processing regular payroll: You provide payroll instructions to the ICP, who then calculates appropriate taxes, social contributions, and net pay according to local regulations.

Handling compliance: The ICP manages ongoing compliance requirements including tax filings, statutory benefits, and adherence to changing employment laws.

Maintaining ongoing management: While the ICP handles administrative and legal aspects, you maintain control over the employee's day-to-day work, performance management, and career development.

The company pays the ICP digital pay provider, which handles salaries, taxes, and benefits through its payroll system. The ICP ensures local tax compliance and meets all mandatory employment regulations. Employees receive their salaries directly from the ICP payroll system, with all necessary deductions applied. This setup streamlines cross-border payments, reduces legal risks, and supports efficient global workforce management.

Who do you pay in an ICP model?

In a good ICP model, you pay the in-country partner directly rather than paying employees. The ICP then distributes the appropriate compensation to employees after handling all necessary deductions and withholdings. This creates a clear financial relationship that simplifies international transactions.

The payment to your ICP typically includes several components: the employee's gross salary, mandatory employer contributions (such as social security and healthcare), statutory benefits required by local law, and the ICP's service fee. This consolidated invoice approach simplifies accounting and ensures all legal obligations are met.

Most ICPs operate on a monthly billing cycle aligned with local pay periods, though some may offer more flexible arrangements. Payment is usually made via international wire transfer, though some global ICP payroll providers now offer more advanced payment options including multi-currency accounts and digital payment platforms.

🎯 Pro Tip: Negotiate transparent fee structures with your ICP that clearly separate employee compensation from service charges. This helps with budgeting accuracy and ensures you can track true employment costs versus administrative expenses.

How does ICP pay employees?

ICPs pay employees through locally compliant methods that align with each country's banking systems and regulations. After receiving your consolidated payment, the ICP calculates the appropriate net salary by deducting income tax, social security contributions, and any other mandatory withholdings required by local law.

The payment process typically follows the standard payroll cycle of the employee's country, which may be monthly, bi-weekly, or semi-monthly depending on local practices. ICPs use local bank transfers in the country's currency to deliver funds directly to employee accounts, ensuring timely and compliant payments.

Beyond basic salary, ICPs also manage the distribution of additional compensation elements including bonuses, commissions, expense reimbursements, and statutory benefits. They provide employees with detailed pay statements that meet local requirements for transparency and documentation.

For multinational teams, sophisticated ICPs offer synchronized payment schedules that align different country payrolls to create a more unified experience across your global workforce, even when local requirements differ significantly.

Which global payroll model is better: local ICPs or owned entities?

The choice between local ICPs and owned entities depends on your business strategy, growth stage, and specific market needs. Each model offers distinct advantages and considerations that should align with your global expansion goals.

Factor | Local ICPs | Owned Entities |

Setup Speed | Days to weeks | Months to years |

Initial Investment | Low (service fees only) | High (legal, banking, office setup) |

Ongoing Costs | Higher per-employee fees | Lower per-employee costs at scale |

Compliance Risk | Shared with partner | Fully on your company |

Market Commitment | Flexible, easy to exit | Long-term commitment |

Control | Limited to operational management | Complete legal and operational control |

Scalability | Excellent for testing markets | Better for established operations |

Local ICPs provide the advantage of speed and flexibility, making them ideal for companies entering new markets, hiring key talent quickly, or maintaining a limited presence in multiple countries. The reduced compliance burden and elimination of entity setup costs make this approach particularly attractive for startups and mid-sized businesses.

Owned entities offer greater control and potentially lower long-term costs once you reach a certain scale in a specific country. They become more advantageous when you have a substantial employee base in a location, need deep integration with local business ecosystems, or require specific operational capabilities that ICPs cannot provide.

Many companies adopt a hybrid approach, using ICPs for initial market entry or in countries with smaller teams, then transitioning to owned entities in key markets as their presence grows. This progressive strategy balances speed and flexibility with long-term cost efficiency and control.

How do I receive ICP payments?

As an employee hired through an ICP arrangement, you'll receive your salary directly from the in-country partner rather than from the company you perform work for. The payment process is designed to be seamless and follows the standard, efficient payroll practices of your country of residence.

During onboarding, you'll provide your banking details to the ICP, who will set up regular direct deposits to your local bank account in your local currency. The payment schedule will follow normal practices in your country (monthly, bi-weekly, etc.) and will include all appropriate deductions for taxes and social contributions.

You'll receive regular pay statements detailing your gross salary, deductions, and net pay, just as you would with any local employer. These statements will come from the ICP entity, which is your legal employer of record, though your day-to-day work will be directed by the company that engaged the ICP services.

For any payment issues or questions about your compensation, you'll typically have access to both the ICP's HR support team and your operational manager at the company you work for, creating a dual support system for resolving any concerns.

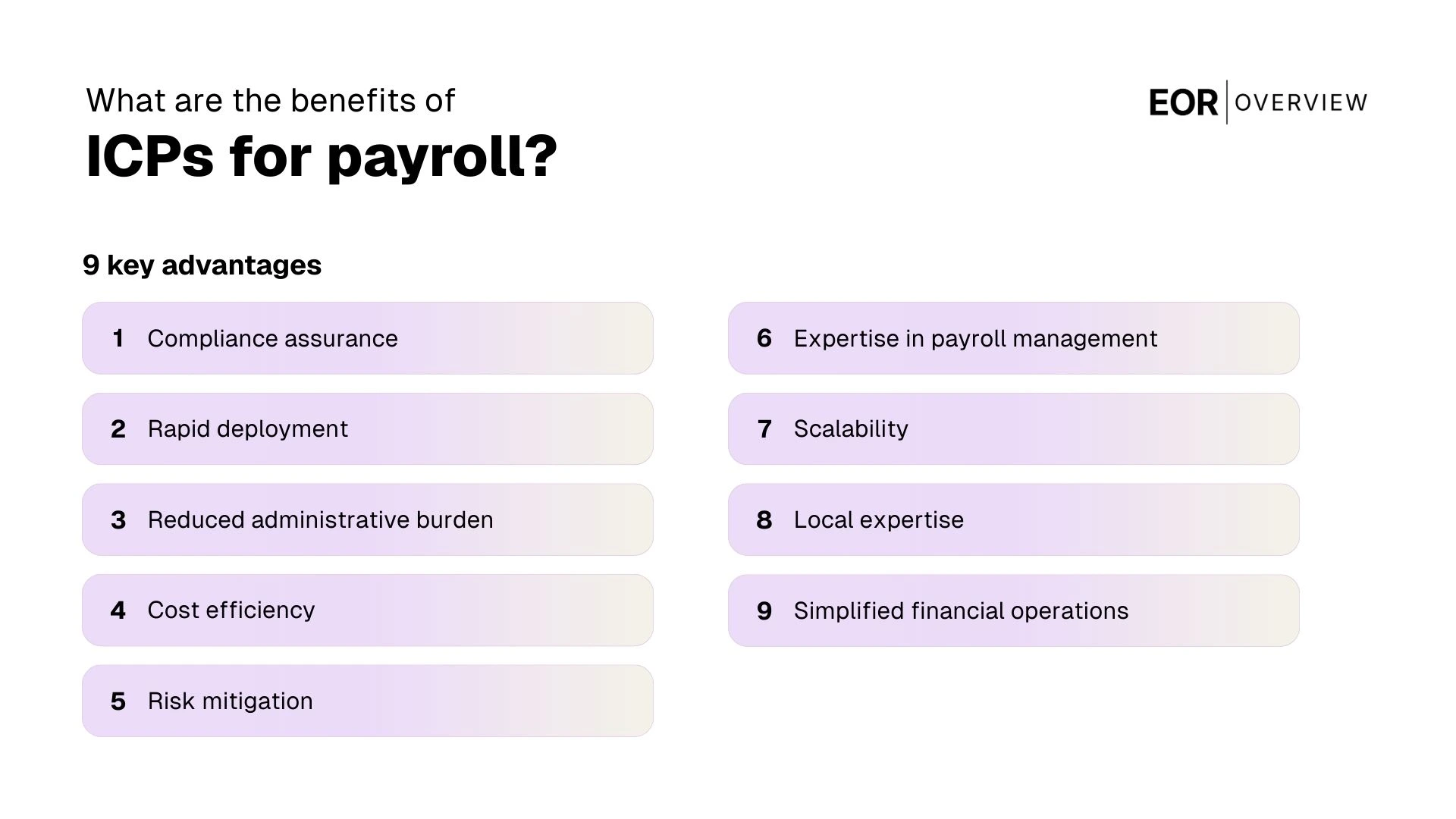

What are the benefits of ICPs for payroll?

The key advantages of using ICPs for global payroll include compliance assurance, rapid deployment, reduced administrative burden, cost efficiency, risk mitigation, expertise in payroll management, scalability, local expertise, and simplified financial operations. These benefits are listed in detail below.

Compliance assurance: ICPs maintain up-to-date knowledge of local employment laws, tax regulations, and mandatory benefits, ensuring your international hiring practices remain fully compliant regardless of changing requirements.

Rapid deployment: You can hire talent in new countries within days rather than months, eliminating the lengthy process of establishing legal entities and understanding complex local regulations from scratch.

Reduced administrative burden: ICPs handle time-consuming tasks including payroll processing, tax filings, benefits administration, and employment documentation, freeing your HR team to focus on strategic initiatives.

Cost efficiency: The ICP model eliminates significant upfront costs associated with entity establishment, local legal counsel, accounting setup, and ongoing compliance management in multiple jurisdictions.

Risk mitigation: ICPs absorb much of the compliance risk associated with international employment, reducing your exposure to potential fines, penalties, or legal disputes arising from regulatory violations.

Expertise in payroll management: ICPs with payroll expertise can efficiently manage salaries, tax deductions, benefits, and compliance. Their knowledge helps reduce payroll errors and ensures employees are paid accurately and on time.

Scalability: You can easily expand or contract your international workforce based on business needs without the commitment of maintaining permanent entities in each location.

Local expertise: ICPs provide valuable insights into local market practices, competitive compensation structures, and cultural nuances that help attract and retain top talent.

Simplified financial operations: The consolidated billing approach streamlines accounting processes, currency management, and financial reporting for your global workforce.

You should maintain ongoing conversations about payroll data and ensure it's provided in a format that supports easy reporting. Non-standard data can cause issues, especially when trying to generate accurate global consolidated reports.

All businesses know that employees must be paid on time, but they also look for ways to improve efficiency and reduce costs. Leadership teams aim to strike a balance by implementing a cost-effective payroll system that still meets local compliance requirements and country-specific needs.

These benefits make ICPs particularly valuable for companies in growth phases, those entering new markets, or organizations with distributed payroll teams across multiple countries. The model allows businesses to focus on core operations while leveraging expert payroll partners to navigate the complexities of global employment.

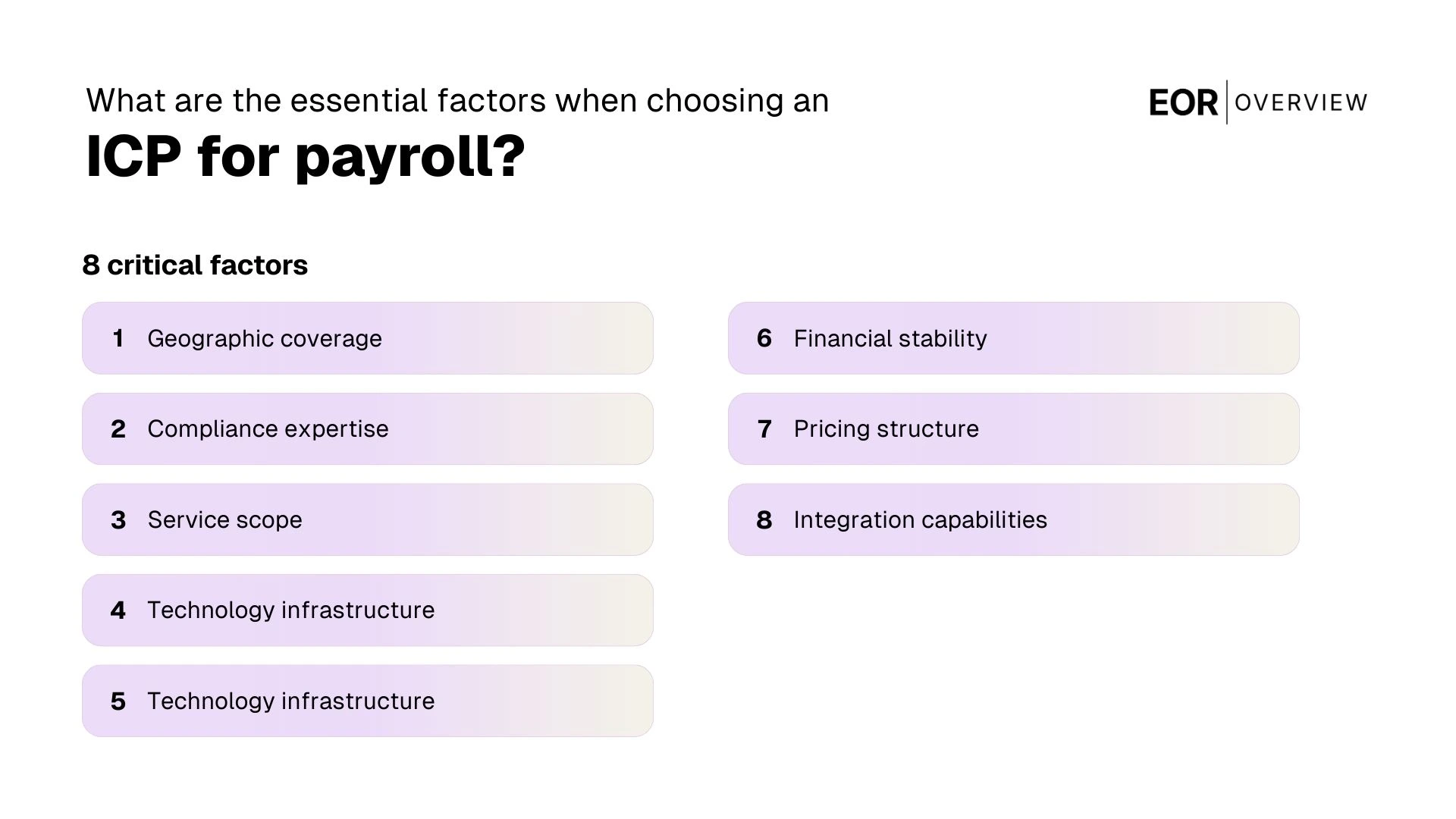

What are the essential factors when choosing an ICP for payroll?

The critical factors to consider when choosing an ICP include geographic coverage, compliance expertise, service scope, technology infrastructure, responsiveness, financial stability, pricing structure, and integration capabilities. These factors are listed in detail below.

Geographic coverage: Ensure the ICP has established entities or strong partnerships in all your target countries, with particular attention to challenging jurisdictions with complex regulations.

Compliance expertise: Verify the ICP's knowledge of local employment laws, tax regulations, and mandatory benefits in each country, including their process for staying current with regulatory changes.

Service scope: Evaluate whether the ICP offers comprehensive services beyond basic payroll, such as benefits administration, equity compensation support, expense management, and HR advisory services.

Technology infrastructure: Assess the ICP's payroll platform, employee self-service capabilities, reporting tools, and data security measures to ensure they meet your operational needs.

Responsiveness: Consider the ICP's support model, including time zone coverage, dedicated account management, response times, and escalation procedures for urgent issues.

Financial stability: Investigate the ICP's business longevity, client retention, and financial health to ensure they can provide reliability to their services throughout your partnership.

Pricing structure: Compare fee models (percentage-based vs. flat fee), transparency of payroll costs, currency handling charges, and any additional fees for special services or transactions.

Integration capabilities: Determine how well the ICP's systems can connect with your existing HR, accounting, and workforce management platforms to create efficient workflows.

When evaluating potential ICPs, request detailed references from current clients with similar needs to your organization. Speaking with these references can provide valuable insights into the partner's performance in real-world scenarios and their ability to handle challenges specific to your industry or target markets.

Many HR managers and finance leaders find that conducting a pilot project with a new ICP in one or two countries before full deployment helps identify potential issues and confirms service quality. This measured approach reduces risk while allowing you to build confidence in the partnership before wider implementation.

Won't multiple ICPs make things more complicated?

This is a common concern among HR and finance leaders considering global expansion. While working with multiple ICPs can introduce complexity, there are effective strategies to manage this challenge and maintain operational efficiency.

The primary complexity arises from managing different contracts, communication channels, invoicing processes, and reporting formats across multiple global payroll providers. Each ICP may have unique requirements and timelines, potentially creating administrative overhead and coordination challenges for your team.

However, there are several approaches to mitigate these complications. Many global companies opt for a consolidated global EOR provider that offers coverage across numerous countries through a single contract and interface. These types of global payroll providers maintain their own network of local partners but present a unified service experience to clients.

For companies that prefer working with specialized regional ICPs for their deeper local knowledge and expertise, implementing a payroll aggregation platform can help. These technologies centralize data from multiple providers into a single dashboard, standardizing reporting and creating a more cohesive management experience.

Another effective strategy is establishing a clear governance framework for your international payroll operations. This includes standardized processes for data collection, approval workflows, compliance verification, and performance monitoring that apply consistently across all ICP relationships.

💡 Innovation: Emerging payroll orchestration platforms now offer API-based connections to multiple ICPs, automating data synchronization and creating a single source of truth for global workforce data. These technologies are reducing the traditional complexity of managing multiple providers while preserving the benefits of specialized local expertise.

The decision between a single global provider versus multiple specialized ICPs should balance your specific needs for local expertise, geographic coverage, service quality, and administrative simplicity. Many organizations find that the benefits of working with best-in-class regional partners outweigh the additional coordination requirements, particularly when supported by appropriate payroll technology and governance frameworks.