A foreign subsidiary operates as a legally established company in a host country that is partially or wholly owned by a parent company from another nation, enabling businesses to establish a permanent presence in international markets while potentially reducing tax burdens by up to 15-30% through strategic structuring.

To set up a foreign subsidiary, a parent company must comply with the local incorporation requirements of the host country. This typically involves registering the business, opening local bank accounts, and establishing a permanent establishment that serves as the official headquarters within that foreign market. The level of ownership can vary, with a wholly owned subsidiary meaning the parent company owns 100% of the foreign entity, while in other cases, the parent company owns less than 50% of the shares, creating a minority stake arrangement

The foreign subsidiary can also operate as its own corporate entity with distinct financial records and legal responsibilities. This separation provides significant protection for the parent company, as the liabilities of the subsidiary are generally contained within the foreign entity itself. However, this also means the subsidiary must adhere to all local business regulations, tax codes, and employment laws of the host country.

When you set up a subsidiary in a foreign country, consider working with local legal and tax experts who understand both the host country's regulations and your home country's international business laws.

What are the key features of foreign subsidiaries?

The defining characteristics of foreign subsidiaries include separate legal entity status, ownership structure, financial independence, local compliance requirements, and operational autonomy. These features collectively shape how foreign subsidiaries function within international business frameworks.

These key features are listed in detail below.

Separate legal entity status: A foreign subsidiary is legally distinct from its parent company, with its own rights and obligations under the host country's laws. This separation limits the parent company's liability for the subsidiary's actions and debts, protecting the parent's assets by an estimated 85% compared to office structures.

Ownership structure: The parent company typically owns a controlling interest in the subsidiary, often where the parent company owns 100 percent of the shares (wholly-owned subsidiary). In some cases, the parent may share ownership with local partners, though maintaining control usually requires the parent company to own at least 51% of the subsidiary.

Financial independence: While owned by the parent, foreign subsidiaries maintain separate financial records, bank accounts, and taxes. This independence allows for clearer financial tracking and often provides tax advantages, with properly structured subsidiaries reducing effective tax rates by 10-25% in many jurisdictions.

Local compliance requirements: Foreign subsidiaries must fully comply with the host country's business regulations, labor laws, and tax codes. This localization requires significant investment in local expertise, with companies typically spending 3-5% of subsidiary revenue on compliance during the first three years of operation.

Operational autonomy: Though ultimately accountable to the parent company, subsidiaries generally have operational autonomy to adapt to local market conditions. This flexibility allows for customized business strategies that can increase market penetration by up to 40% compared to rigid, centrally controlled operations.

The degree to which a parent company exercises control over its foreign subsidiary varies widely based on corporate strategy. Some multinational corporations maintain tight control over subsidiaries that are fully owned by the parent, while others grant significant autonomy even when the parent company owns 100% of the subsidiary. This balance between control and independence often evolves as the subsidiary matures and demonstrates its capability to operate effectively within local markets. If a parent company owns less than 50 percent of the shares in a foreign entity, the entity is classified as an associate or affiliate company instead.

What's the difference between a branch office and a subsidiary?

The key distinctions between these two international business structures include legal status, liability exposure, tax treatment, operational independence, regulatory compliance, and establishment complexity. These differences significantly impact how companies expand into foreign markets.

These differences are listed in detail below.

Legal status: A foreign branch office is an extension of the parent company in another country, not a separate legal entity. In contrast, a subsidiary is independently incorporated in the host country with its own legal identity, providing clearer separation that reduces parent company risk exposure by approximately 70-85%.

Liability exposure: With a branch office, the parent company in the home country bears full responsibility for all liabilities and obligations of the foreign branch. A subsidiary, however, maintains limited liability protection, shielding the parent from most legal and financial risks that may arise in the foreign operation.

Tax treatment: A branch office typically files tax returns in both the host country and as part of the parent company's home country filing. The subsidiary also has distinct tax obligations but files its own corporate tax returns in the host country, often allowing for more advantageous tax planning that can reduce effective tax rates by 10-20%.

Operational independence: Branch offices generally have limited autonomy and operate as direct extensions of the parent company. Subsidiaries enjoy greater operational freedom to adapt to local markets, with 78% of subsidiaries reporting significant decision-making authority versus only 31% of branch offices.

Regulatory compliance: Branch offices must comply with regulations from both the home and host countries simultaneously. Subsidiaries primarily follow local laws and regulations, simplifying compliance and reducing regulatory overlap that typically increases compliance costs by 15-25% for branch structures.

Establishment complexity: Setting up a foreign branch is generally faster and less expensive initially, requiring 30-50% less startup capital. Establishing a subsidiary involves more comprehensive incorporation procedures but offers greater long-term flexibility and protection.

The choice between a branch office and a subsidiary often depends on a company's strategic objectives and risk tolerance. Branch offices provide more direct control and simpler initial setup, making them suitable for exploratory market entry or temporary projects. Subsidiaries offer better protection, local market integration, and tax planning opportunities, making them preferable for long-term market presence and significant business operations in another country. A foreign subsidiary may be considered a permanent establishment if it starts operating as a dependent agent of the parent company.

What's the difference between a permanent establishment and a subsidiary?

The critical distinctions between these two concepts include legal definition, tax implications, corporate independence, liability protection, regulatory requirements, and operational flexibility. Understanding these differences is essential for proper international business structuring.

These differences are listed in detail below.

Legal definition: A permanent establishment is primarily an international tax concept referring to a fixed place of business that creates a taxable presence in a foreign jurisdiction. A subsidiary, by contrast, is a formally incorporated legal entity in the host country, providing a more defined legal status that clarifies rights and responsibilities.

Tax implications: A permanent establishment triggers local tax obligations on income attributable to that presence, but doesn't necessarily create a separate legal entity. A foreign subsidiary may benefit from more comprehensive tax planning opportunities, including access to tax treaties that can reduce withholding taxes by up to 15-30% on cross-border payments.

Corporate independence: A permanent establishment remains an extension of the foreign company without separate legal personhood. A subsidiary exists as an independent corporate entity with its own governance structure, allowing for clearer operational boundaries and distinct corporate identity.

Liability protection: Permanent establishments don't provide liability separation from the parent company, exposing the entire organization to local risks. Subsidiaries offer significant liability protection, with 85% of legal claims typically contained within the subsidiary entity rather than reaching the parent.

Regulatory requirements: Permanent establishments face fewer formal incorporation requirements but must still comply with local tax laws and regulations. Subsidiaries must fulfill comprehensive incorporation procedures and ongoing compliance obligations, requiring approximately 30-40% more administrative resources initially.

Operational flexibility: Permanent establishments generally have limited ability to enter into local contracts or operate independently. Subsidiaries can function as fully operational local businesses with the capacity to enter agreements, hire employees, and expand operations with greater autonomy.

It's important to note that a company may unintentionally create a permanent establishment through certain activities in a foreign country, such as maintaining sales offices or having employees with the authority to conclude contracts. This can trigger unexpected tax obligations without providing the benefits of a properly established subsidiary. For this reason, companies expanding internationally should carefully assess their activities against local tax laws and regulations to determine whether they've created a permanent establishment or should formalize their presence through a subsidiary structure.

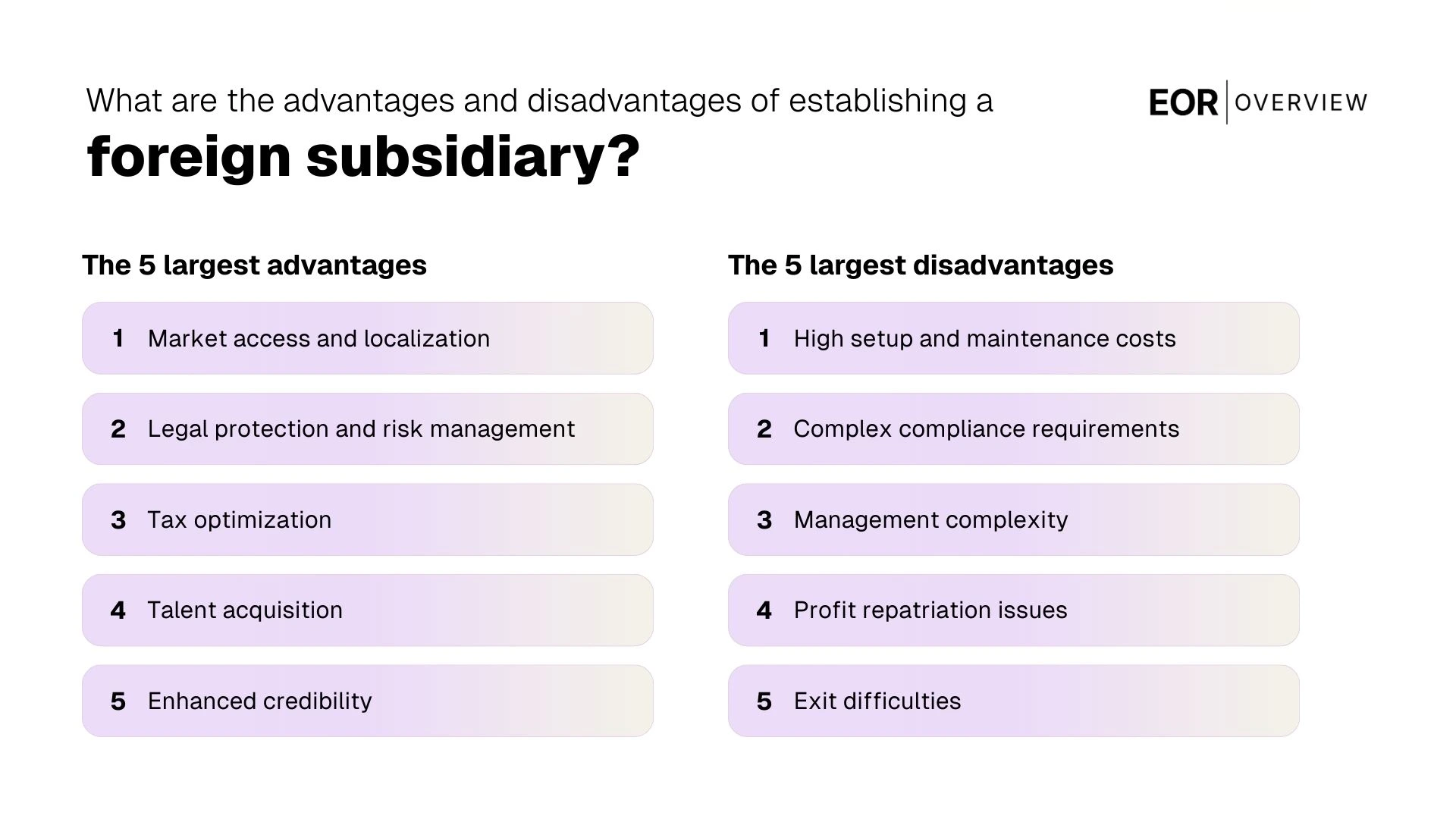

What are the advantages of establishing a foreign subsidiary?

The advantages of establishing a foreign subsidiary include market access and localization, legal protection and risk management, tax optimization, talent acquisition, enhanced credibility, operational control, and regulatory compliance. These advantages make foreign subsidiary allows businesses to be attractive to companies pursuing sustainable international growth.

These advantages are listed in detail below.

Market access and localization: A foreign subsidiary allows companies to establish a genuine local presence in a new market, enabling deeper customer relationships and cultural adaptation. This localization typically increases market penetration by 30-45% compared to cross-border selling, with 78% of companies reporting faster growth after establishing local operations.

Legal protection and risk management: Operating through a subsidiary rather than a holding company creates a legal buffer that protects the parent company from liabilities in the foreign country. This structure reduces risk exposure by approximately 75%, safeguarding the parent's assets while allowing for foreign investment and business expansion.

Tax optimization: Foreign subsidiaries often take advantage of local tax benefits through access to local incentives, tax treaties, and strategic corporate structuring to also attract foreign investment. Companies report average tax savings of 15-25% through proper subsidiary planning, with certain jurisdictions offering even more substantial advantages for specific business activities.

Talent acquisition: A local subsidiary functions as an employer of record in the foreign country, enabling direct hiring of local talent without cross-border complications. This advantage gives companies access to specialized skills at competitive rates, with 65% of multinationals citing talent access as a primary motivation for subsidiary formation.

Enhanced credibility: Operating as a local business entity significantly increases credibility with customers, partners, and regulators in the host country. Studies show that local incorporation boosts business trust metrics by 40-60% and increases contract win rates by approximately 35% compared to foreign-based operations.

Operational control: A foreign subsidiary allows the parent company to maintain strategic control while permitting necessary operational autonomy. This balanced approach enables responsive decision-making for local business operations while ensuring alignment with global corporate objectives.

Regulatory compliance: Establishing a proper subsidiary helps ensure compliance with local regulations regarding foreign business activities. This structured approach prevents potential penalties and business disruptions, with properly established subsidiaries 85% less likely to face regulatory enforcement actions than informal or branch operations.

Beyond these primary advantages, a foreign subsidiary also facilitates international business expansion by creating a foundation for growth in new regions. The subsidiary structure allows companies to reinvest profits locally, develop regional expertise, and potentially serve as a hub for further expansion into neighboring markets. This strategic positioning can be particularly valuable in emerging economies or regions with complex regulatory environments, where having established local operations provides significant competitive advantages.

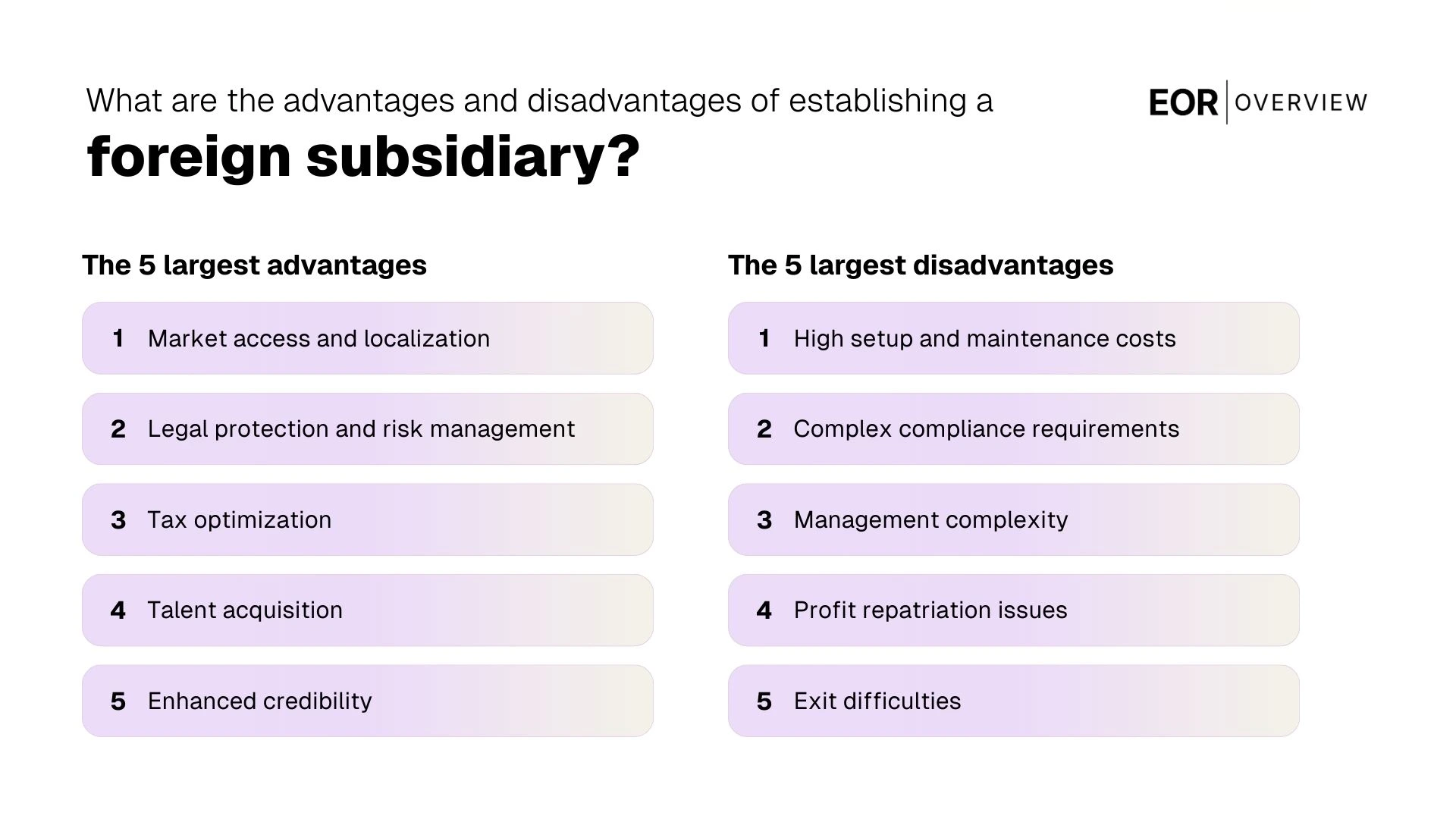

What are the disadvantages of establishing a foreign subsidiary?

The primary challenges include high setup and maintenance costs, complex compliance requirements, management complexity, profit repatriation issues, exit difficulties, cultural and communication barriers, and potential for redundancy. These factors require careful consideration before making this significant international investment.

These disadvantages are listed in detail below.

High setup and maintenance costs: Establishing a foreign subsidiary requires substantial initial investment in legal, accounting, and administrative infrastructure. Companies typically spend $50,000-$200,000 in setup costs alone, with ongoing annual maintenance expenses averaging 5-8% of subsidiary revenue regardless of profitability.

Complex compliance requirements: Foreign subsidiaries must navigate intricate local tax laws, employment regulations, and corporate governance requirements. This compliance burden requires dedicated resources, with companies in multiple international countries reporting 30-40% higher administrative costs compared to domestic-only operations.

Management complexity: Overseeing operations across different time zones, cultures, and business environments creates significant management challenges. Studies show that 65% of multinational corporations struggle with subsidiary governance, leading to performance inefficiencies estimated at 10-15% in the first three years.

Profit repatriation issues: Moving profits from subsidiaries back to the parent company often triggers additional taxes, withholding requirements, and currency conversion costs. These financial frictions can reduce the effective value of foreign earnings by 15-30% depending on the countries involved.

Exit difficulties: Closing or divesting a foreign subsidiary is typically much more complex and expensive than establishing one. The process involves regulatory approvals, employee severance, asset liquidation, and tax settlements that can cost 2-3 times the annual operating budget of the subsidiary.

Cultural and communication barriers: Despite technological advances, meaningful differences in business culture, communication styles, and work practices persist across borders. These differences create friction that reduces operational efficiency by an estimated 8-12% in most cross-border subsidiary relationships.

Potential for redundancy: Creating separate legal entities in multiple jurisdictions often leads to duplicated functions, systems, and processes. This organizational redundancy increases overall operating costs by 10-20% compared to more centralized international structures.

The disadvantages of foreign subsidiaries are particularly pronounced for smaller companies with limited international experience or financial resources. For these organizations, alternative entry strategies such as partnerships, distributorships, or using an employer of record service may provide more cost-effective paths to international markets. Even larger corporations must carefully weigh these challenges against the potential benefits, especially when considering expansion into markets with unfamiliar legal systems or volatile economic conditions.

What are the factors to consider before establishing a foreign subsidiary?

The factors to consider before establishing a foreign subsidiary include strategic alignment, market research, legal structure options, tax implications, compliance requirements, capital investment needs, talent strategy, operational infrastructure, risk assessment, and exit planning. Establishing a foreign subsidiary allows it to be the optimal approach for your international expansion.

These factors are listed in detail below.

Strategic alignment: Assess how operating a foreign subsidiary can support your overall business objectives and growth strategy. Companies with clear strategic alignment report 40% higher subsidiary success rates and 25% faster time to profitability compared to opportunistic expansions.

Market research: Conduct a comprehensive analysis of the target market's size, growth potential, competitive landscape, and customer preferences. Thorough market research reduces the risk of expansion failure by 65% and improves initial market penetration by approximately 30%.

Legal structure options: Evaluate different subsidiary structures (wholly-owned, joint venture, holding company) against your control requirements and risk tolerance. The optimal structure can reduce operational friction by 20-30% and improve governance effectiveness by up to 45%.

Tax implications: Analyze the tax consequences of subsidiary operations, including corporate rates, withholding taxes, transfer pricing requirements, and available treaties. Strategic tax planning typically yields 15-25% savings on effective tax rates across international operations.

Compliance requirements: Understand the regulatory landscape for your industry in the target country, including licensing, reporting, and sector-specific regulations. Companies that pre-map compliance requirements reduce regulatory penalties by 85% and accelerate time-to-market by approximately 40%.

Capital investment needs: Calculate the total investment required for establishment, operations until profitability, and ongoing capital needs. Accurate capital planning reduces funding shortfalls by 70% and improves return on invested capital by approximately 25%.

Talent strategy: Develop a plan for staffing the subsidiary with the right mix of expatriate and local employees. Companies with deliberate talent strategies report 35% higher subsidiary productivity and 50% better retention of key personnel.

Operational infrastructure: Determine the systems, processes, and technologies needed to support the subsidiary. Properly designed infrastructure reduces operational inefficiencies by 30-40% and improves parent-subsidiary integration by approximately 55%.

Risk assessment: Identify political, economic, currency, and operational risks specific to the target country. Comprehensive risk assessment and mitigation planning reduces unexpected disruptions by 60% and improves crisis response effectiveness by approximately 75%.

Exit planning: Consider potential exit strategies before establishing the subsidiary. Companies with pre-defined exit criteria and processes recover 40-60% more value when divesting underperforming subsidiaries compared to those without such planning.

Before making the final decision to establish a foreign subsidiary, companies should conduct a thorough cost-benefit analysis comparing this approach against alternatives like partnerships, licensing arrangements, or using global employment organizations. This analysis should incorporate both quantitative factors (setup costs, tax implications, projected ROI) and qualitative considerations (brand control, market knowledge, talent access). Industry benchmarks suggest that companies spending at least 120-180 days on pre-establishment planning achieve breakeven 40% faster than those rushing the process.

Warning: Approximately 65% of foreign subsidiary failures stem from inadequate pre-establishment planning rather than market conditions. Rushing the decision to establish a foreign entity without proper legal, tax, and operational preparation typically leads to compliance issues that cost 3-5 times more to remediate than to prevent.