13th month pay is a mandatory or customary additional salary payment that provides employees with an extra month's wages, typically distributed at year-end to support holiday expenses and boost annual compensation.

For HR managers and hiring leaders in tech, finance, and startup environments, understanding 13th month pay requirements is crucial for competitive global talent acquisition and legal compliance. This compensation structure affects your total employment costs, influences candidate expectations, and determines your ability to attract top international talent while avoiding costly legal missteps.

With remote work enabling companies to hire across dozens of countries, navigating diverse compensation traditions like 13th month pay has become a strategic advantage for organizations serious about building world-class distributed teams.

For global employers expanding into markets where 13th month salary is standard practice, understanding this compensation structure becomes essential for compliant payroll management. The payment is calculated based on the employee's total annual salary divided by twelve months, regardless of their actual start date or employment duration during the year.

Some countries and companies extend this concept further with a 14th month pay or additional bonuses tied to performance metrics. When you calculate these payments, they're typically prorated for employees who haven't worked the full year, ensuring fair compensation while maintaining legal compliance across different jurisdictions.

Is it required or expected to pay a 13th month salary?

The requirement for a 13th month salary varies significantly across countries around the world, with many nations mandating this additional payment by law while others leave it to employer discretion. This practice originated in the Philippines in the 1970s and has since spread throughout many countries, particularly in Latin America, Asia, and parts of Europe.

In regions where the 13th month bonus is required by law, employers must provide this additional monthly salary payment to eligible employees before the end of the calendar year. Countries like Argentina, Brazil, Mexico, and the Philippines have specific legal frameworks governing these payments, making compliance essential for global payroll management.

However, certain employee categories may be exempt from receiving the 13th month pay, depending on local regulations. High-level executives, commission-based workers, or employees with specific contractual arrangements might not qualify for this Christmas bonus in some jurisdictions.

For companies operating internationally, understanding these requirements becomes crucial for effective global payroll administration. While some countries mandate the payment as part of standard employment law, others treat it as a voluntary benefit that can enhance employee satisfaction and retention in competitive markets.

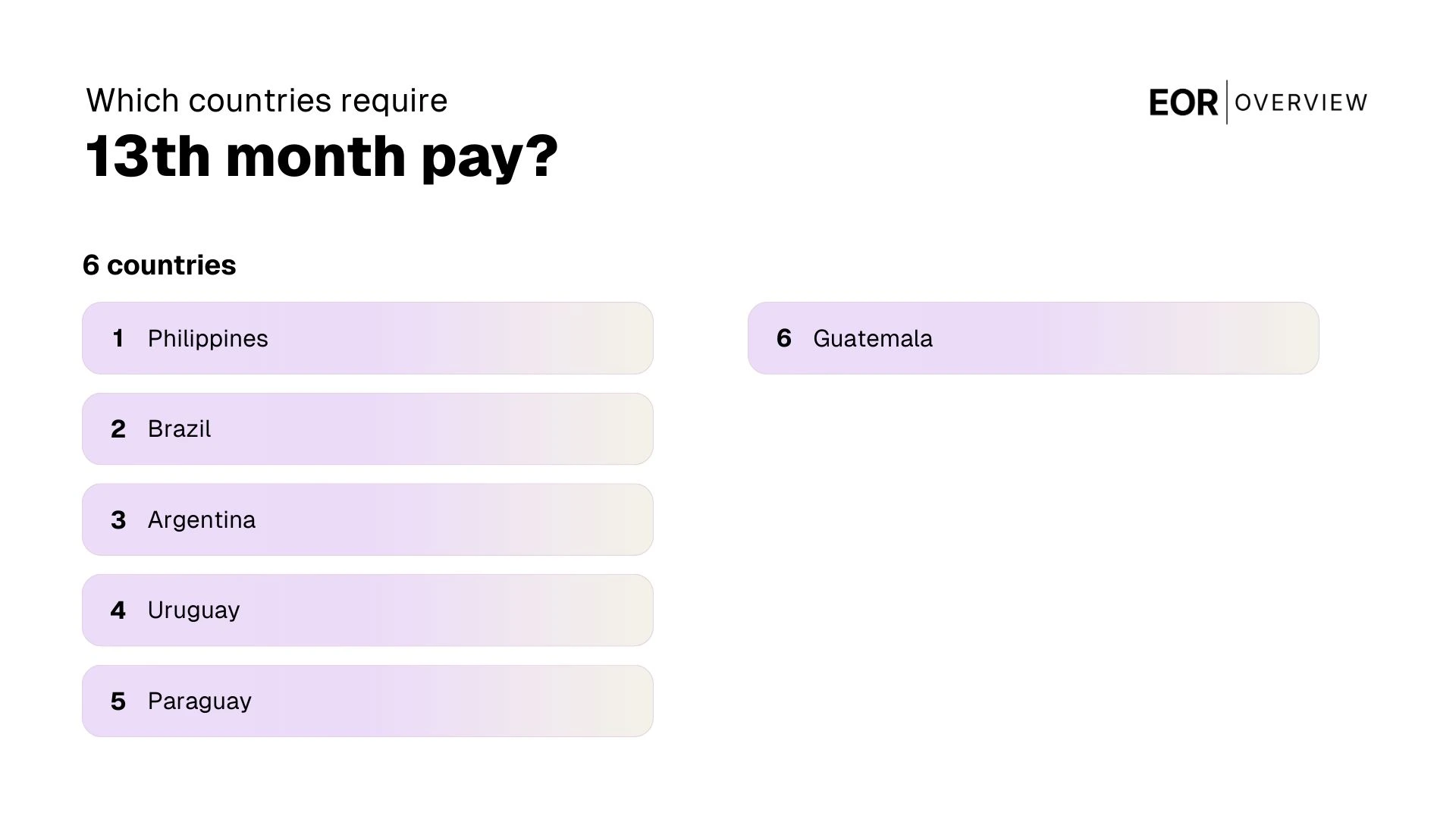

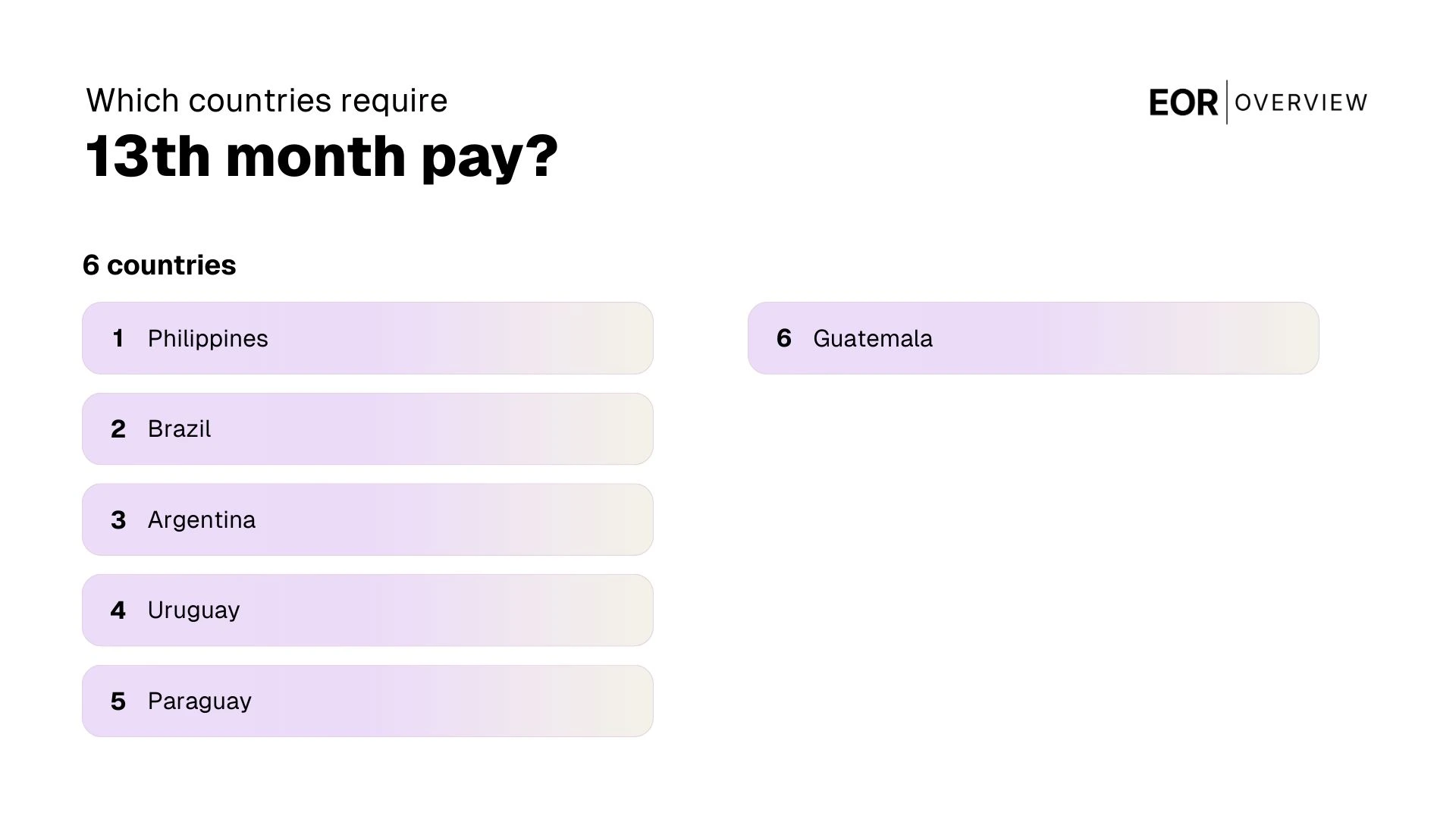

Which countries require 13th month pay?

Understanding which countries mandate this additional compensation is crucial for global hiring strategies. Several nations have established legal requirements for the 13th-month pay as part of their local labor laws, making it a mandatory extra payment rather than an optional perk.

Philippines: Requires all employers to pay employees an amount equivalent to one-twelfth of their annual basic salary, typically distributed in two installments during mid-year and December.

Brazil: Mandates the 13º salário as part of the employment contract, paid in two parts - November and December - for all formal employees including some categories of freelancers.

Argentina: Legally requires the aguinaldo payment twice yearly, calculated as half of the employee's highest monthly salary within each semester.

Uruguay: Enforces mandatory holiday bonus payments equivalent to one-twelfth of annual earnings, distributed in June and December.

Paraguay: Stipulates 13th-month compensation through labor legislation, ensuring workers receive this extra payment before Christmas.

Guatemala: Requires the bono 14 payment as mandatory additional compensation beyond regular salary structures.

🎯 Pro tip: Always consult with local labor law experts before establishing international employment contracts, as 13th-month pay requirements can vary significantly in calculation methods and payment schedules even within mandating countries.

How is 13th month pay calculated?

The calculation method for 13th month pay varies significantly across countries where 13th month pay is mandated. Most countries require the thirteenth month pay to equal one month's basic salary, calculated by dividing the employee's annual base salary by 12.

Global HR teams typically encounter three primary calculation approaches: basic salary division, proportional calculation, and enhanced bonus structures. These methods determine how employees receive 13th month pay based on local regulations.

Basic salary method: Employees receive one-twelfth of their annual base salary, excluding overtime, commissions, and allowances.

Proportional calculation: New employees or those who haven't worked the full year receive a prorated amount based on months worked.

Enhanced structures: Some organizations in countries where 13th month pay is common also provide a 14th month salary or additional year-end bonus beyond the mandatory requirement.

Understanding the difference between 13th month pay and discretionary bonus pay is crucial for accurate calculations. While mandatory 13th month payments follow specific formulas, additional year-end bonuses remain at the employer's discretion and can supplement the required payment.

Is 13th month pay a bonus?

The 13th month pay is not technically a bonus in the traditional sense, though many employees receive this additional payment as supplemental compensation. While bonuses are typically discretionary rewards based on performance or company profits, 13th month pay represents a mandatory salary payment in many jurisdictions where it's required by law.

This concept of 13th month pay originated in the Philippines and has since spread to numerous countries in Latin America, where it's become an integral part of payroll requirements. Unlike performance bonuses, this additional payment is calculated as a fixed percentage of the employee's annual base salary, making it a predictable compensation component rather than a variable reward.

The key distinction lies in the mandatory nature of 13th month pay versus the discretionary aspect of traditional bonuses. Countries that offer 13th month pay typically require employers to provide this additional compensation regardless of company performance or individual achievements. This creates a more stable income structure for employees while ensuring compliance with local labor laws and payroll requirements.

When is 13th month pay given?

The timing of 13th month pay varies significantly across different countries around the world, with each nation establishing its own legal framework and payment schedules. In most jurisdictions where this benefit is mandatory, employers must distribute the payment by a specific deadline, typically aligned with major holidays or fiscal year-end periods.

Countries like Brazil require employers to pay the first installment between February and November, with the final portion due by December 20th. This staggered approach helps employees manage their finances throughout the year while ensuring they receive the full benefit before the holiday season. The payment, equivalent to one month's salary, is calculated as one-twelfth of the employee's annual salary accumulated over the working period.

In the Philippines, all employees eligible to receive 13th month pay must receive their payment no later than December 24th each year. This timing coincides with Christmas celebrations, providing workers with additional funds during a traditionally expensive period. Similarly, other Latin American countries typically schedule payments in November or December to support holiday expenses.

For employees who haven't worked the full calendar year, the calculation adjusts proportionally based on their actual service period. The one-twelfth of the employee's annual earnings formula ensures fair compensation regardless of start date, making this benefit accessible to both long-term and newer team members.

Who is eligible to receive 13th month pay?

Eligibility for 13th month pay varies by country and depends on specific employment regulations in each jurisdiction. Most countries that mandate this type of payment require employers to provide it to employees who meet certain criteria, though the exact requirements differ significantly across regions.

Full-time employees typically qualify for 13th month pay in countries where it's mandated, provided they have completed a minimum service period. Part-time workers may also be eligible on a prorated basis, with their payment calculated proportionally to their working hours and length of service.

The calculation base for this type of payment usually includes the employee's total base salary earned during the year, excluding overtime, bonuses, and other variable compensation. Some jurisdictions include allowances and regular benefits in the calculation, while others strictly limit it to basic salary components.

It's important to note that 13th month pay is generally taxable income, subject to the same tax rates and withholding requirements as regular salary payments. HR managers should consult local labor laws and tax regulations to ensure proper compliance with eligibility requirements and payment calculations in their specific operating jurisdictions.

What is the difference between 13th month pay and a year-end bonus?

While both 13th month pay and year-end bonuses provide additional compensation to employees, they differ significantly in their legal requirements and structure. Countries that require a 13th-month payment mandate this compensation by law, making it a non-negotiable part of compliant payroll practices. Year-end bonuses, however, remain discretionary rewards that companies can offer based on performance, profits, or company policies.

The calculation methods also vary considerably between these two compensation types. When employers offer a 13th-month payment, they typically calculate it as one-twelfth of the employee's annual salary, distributed either monthly or as a lump sum. Year-end bonuses fluctuate based on individual performance metrics, company profitability, or predetermined bonus structures that may range from flat amounts to percentage-based calculations.

Understanding where these practices pay originate helps clarify their purpose and implementation. The 13th month concept emerged from labor protection laws designed to provide workers with additional financial security during holiday seasons. Year-end bonuses developed as performance incentives and retention tools, allowing companies flexibility in rewarding exceptional contributions while boosting employee morale during competitive hiring periods.

When expanding internationally, research local labor laws early in your hiring process. Some countries require employers to provide 13th month pay regardless of company size or industry, making this a critical factor in your total compensation budgeting and compliant payroll setup.

Does 13th month pay apply to contractors?

The application of 13th month pay to contractors depends heavily on the classification and labor and employment laws of each jurisdiction. In most countries where 13th month pay is required to be paid, the obligation typically extends only to employees, not independent contractors.

However, the distinction becomes complex in global employment scenarios where misclassification can trigger significant penalties for non-compliance.

Companies engaging contractors in countries with mandatory 13th month pay requirements should carefully review local regulations, as some jurisdictions may require this additional compensation for certain types of contract workers, particularly in regions where these payments are designed to compensate for low minimum wages.

The payment must be paid according to local standards when contractors fall under employee-like classifications. For organizations managing international contractor relationships, partnering with employer of record services can provide essential guidance on compliance requirements and help navigate the complex landscape of contractor versus employee obligations across different markets.

Visa-sponsored employees from regions across latin america often expect the practice of providing a 13th month payment as part of their standard compensation package, creating unique considerations for employers navigating international hiring. When these employees relocate to countries without mandatory 13th month requirements, the absence of this familiar benefit can significantly impact their financial planning and overall job satisfaction.

Many visa-sponsored workers budget their annual expenses expecting this additional payment paid in december at the end of the calendar year, and may divide their expected annual salary by 12 plus the bonus month to determine their monthly financial commitments.

Forward-thinking employers who understand this cultural expectation often structure compensation packages to include year-end bonuses or additional payments like 13th month pay to attract and retain top international talent, recognizing that competitive global hiring requires adapting to diverse compensation expectations rather than imposing local standards on international employees.

How can businesses in the US implement 13th-month pay?

US businesses can successfully implement 13th-month pay by first establishing a clear policy framework that defines eligibility criteria, calculation methods, and payment timing. Companies managing a global team should align their US 13th-month pay structure with existing international compensation practices to maintain consistency across regions. The calculation typically involves dividing the employee's annual base salary by 12, though some organizations prefer using the average monthly earnings over a specific number of months to account for salary increases or bonuses throughout the year.

Ensure your 13th-month pay policy complies with federal and state wage and hour laws, as improper implementation can lead to overtime calculation disputes and potential legal complications with the Department of Labor.

Implementation requires careful coordination between HR, payroll, and finance teams to ensure accurate calculations and timely disbursement. Most companies choose to distribute the payment in December to coincide with holiday expenses, though quarterly or mid-year distributions are also viable options. Proper documentation and employee communication are essential to set clear expectations and avoid confusion about eligibility requirements and payment schedules.